Are you thinking about Key Person life insurance?

For business continuity and potential tax benefits, Key Person is often a solution for businesses.

Bluestone understands Businesses

Understanding closely-held businesses is in our DNA. Our Founder and CEO founded a fee-only financial advisory firm that specialized in capital allocation and asset protection for business owners. We work well with business owners, and your CPAs and financial advisors.

Get to know us. Bluestone Life was recognized as Best in the World in the Certified B Corp community.

What is Key Person?

"Key Person" life insurance recognizes the value of the key people that a business needs to successfully run the business. It can also provide a greater yield on retained earnings. It is a life insurance policy that provides a death benefit to a business if its owner or another significant employee passes away.

Identifying and protecting the key employees that contribute to the value of your business is one of the most important discussions you can have when it comes to business continuity.

Here are a few key questions to ask:

- If the key person passes away or becomes disabled, what is the impact on the business?

- Would the company require some adjustment time before business could continue?

- Would sales in progress be completed?

- Would creditors demand payment or restrict future credit?

- What's the ripple effect...would the loss of unique talents and skills disrupt the work of others?

By putting relative values on each of these factors and relating that to sales and profits, you can quantify the value of key employees and make sure it's reflected in your life insurance strategy.

A Bluestone team member can work with you and your team to craft a Key Person life insurance policy that protects your business and provides a greater yield on retained earnings. Think of it as both protection for the business and a tax planning tool. Schedule a call to talk with us and experience the Bluestone difference.Our Premiums with Purpose™ benefit nonprofits

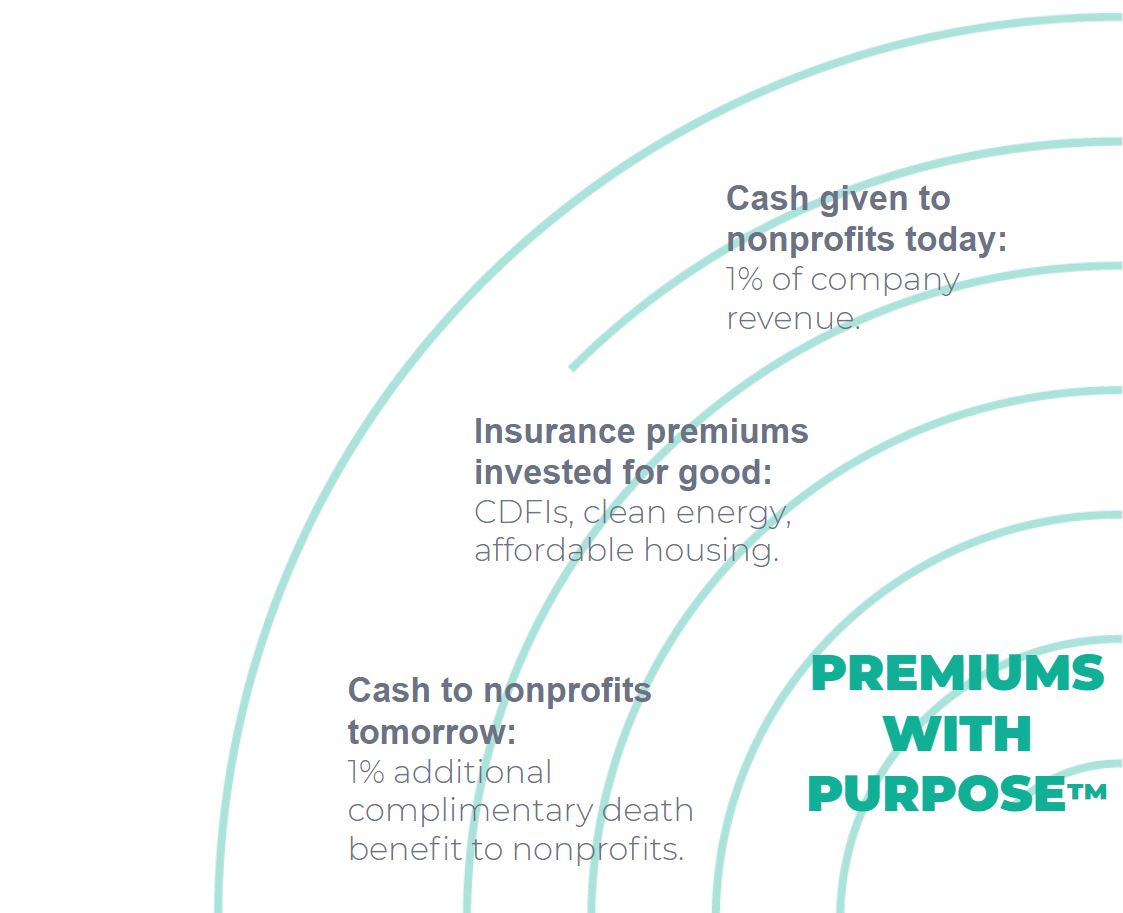

Beyond standard asset protection, every Bluestone policy has a triple impact for nonprofits. Our Premiums with Purpose™ benefit nonprofits working for social and environmental progress. Here's how:

With the additional complimentary death benefit, you get to choose a nonprofit that aligns with your values.

Transparent products. Exceptional value.

Our Bluestone Universal Life Insurance has no premium charge or sales load. One hundred percent of planned and unscheduled premiums that you pay will be added to the accumulated value of your policy. This means that your account value grows.

We look forward to talking with you soon. Shoot us an email and a Bluestone team member will reach out.